Anatellô

Monthly Archive

How to Manage Risk to Get Bigger Innovation Rewards. Part I

In most things there is a correlation between the level of risk you take and the level of reward you make.

If you and your team can manage risk in innovation better, then you’re going to be able to take on more ambitious projects and get those bigger rewards. Bigger rewards of innovation mean bigger revenues and greater returns on your innovation investment.

However, it’s easy to confuse managing risk in innovation with avoiding risk.

When teams seek to avoid risk, they stick to incremental innovation. They don’t seek to develop highly differentiated products or breakthrough technologies – where the opportunities for big rewards lie.

However, that doesn't stop it from being a popular strategy! Research* has shown that 85-90% of projects in the average innovation portfolio are ‘low risk’.

How to Improve Risk Management in Innovation.

Risk can be managed in innovation.

Innovation portfolio management is a key way to do this . It can help you improve your risk/reward balance – so that you can get bigger rewards.

This is because while many aspects of your innovation process focus on doing projects right, the strategic element of portfolio management helps teams to focus on ‘doing the right projects.’

Portfolio management offers a variety of methods for selecting the right innovation projects.

Project Selection on Financial Criteria.

By far the most common way of prioritising projects for the innovation portfolio is on financial analysis. This is usually an NPV calculation or a payback calculation. 77% of companies in one research study used financial criteria alone.

However, by itself this can be an unsatisfactory way of selecting projects. This is because the quality of data that is used for the financial calculations is often quite poor.

Using financial criteria alone has been shown to deliver an unbalanced portfolio of lower value projects and projects that are not aligned with the organisation’s strategy.

This is understandable – the project is at a relatively early stage – pre-development. So forecasted information for aspects such as market penetration and share, retail price and unit cost of production is only approximate.

Research has also shown that it is better to use a variety of methods in combination for project selection in portfolio management to get a better balance.

Here are three other methods to select projects for an innovation portfolio and optimise the risk/reward balance.

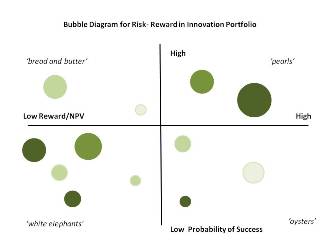

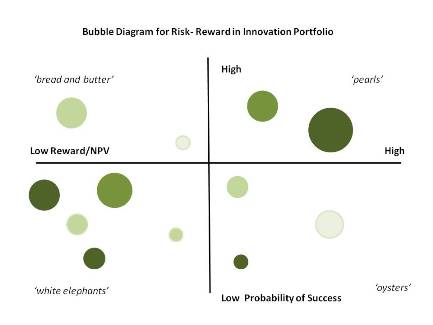

The Risk Reward Bubble Diagram.

Each circle represents an innovation project in the portfolio.

The horizontal axis is a measure of potential reward. The vertical axis is the probability of success.

The size of the bubble represents the annual resources committed to each project. The shading represents the time to launch.

One benefit of the bubble diagram model is that it can help deal with the issue many organisations face of having more projects than resources.

The sum of the bubbles must be equal to the product development budget. If a new project is added, then extra resources must be committed or projects to that value have to be removed.

Scorecard

A scorecard can be developed to rate and rank projects at gate meetings. When the score cards are tallied a Project Attractiveness Score is created which can be used to rank projects.

A good scorecard will include dimensions such as:-

- Strategic fit and alignment

- Product advantage

- Degreee to which it leverages core competencies

- Market attractiveness.

Scorecard models have been shown to be particularly effective at helping select high-value projects and yielding a balanced portfolio.

Success Criteria.

These can be developed for each gate in your innovation process and include metrics on profitability, first year sales, test market results etc.

Finally

Innovation teams know better than anyone how innovation projects are more risky than everyday operations. This can lead to risk avoidance as teams don't want to 'let down' the rest of the organisation.

But innovation teams who can manage risk better can do much more for their organisation than this. Through successful and ambitious innovation they can contribute significantly to that huge ‘growth gap’ that many companies are looking to fill.

* Source: Managing Risk and Reward in an Innovation Portfolio. George S Day. Harvard Business Review

Additional Resources

Want to Learn More about Risk and Innovation?

Contact us for information about our innovation training "How to Make Innovation Less Risky"

© Anatello Ltd 2015. All Rights Reserved.

Comments

Post new comment